PM FPX 5333 Assessment 1 Budget Analysis Report

Student Name

Capella University

PM-FPX5333 Project Budgeting, Procurement, and Quality

Prof. Name:

Date

Introduction:

We will start by analyzing the budget, which involves tracking cash flow within a project. This analysis is essential for understanding how payments are managed, received, and disbursed. Ensuring a consistent cash flow each month is critical for the sustainability of the project. Essentially, cash flow analysis evaluates the financial health of a business, which can be crucial for transitioning from simply starting a business to successfully operating one (2022).

Currently, the Nearlyfree project is in progress. Although the project has adhered to its allocated budget, it has reached the halfway mark and is now facing issues that suggest it may fail. Consequently, the project team has sought our help for guidance and project management services. After a thorough review, we focused on addressing the project’s needs and evaluating its financial status. This assessment enabled us to develop a cost estimation report that could potentially steer the project back on track. The analysis will include elements such as the Work Breakdown Structure (WBS), Total Cost of Ownership (TCO), and Return on Investment (ROI). Additionally, the report will apply cost estimation techniques derived from the cost estimation report, the current financial situation, and contingency plans designed to address potential points of project failure.

Current Financial State:

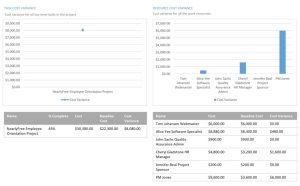

The initial budget for the Nearlyfree New Employee Orientation project was $25,000. However, an analysis of the project’s financial status indicates that the budget is likely to be exceeded. Initially, the baseline cost was $23,300, but the total project cost has now risen to $30,380, resulting in an overage of $8,080 from the original budget. These figures are concerning, particularly since the project is only halfway completed but has already exceeded its budget. To meet the project’s timeline, additional funds are urgently required.

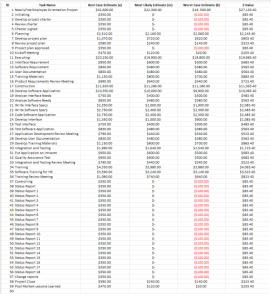

The project leadership relied on an analogous cost data estimating approach, which proved insufficient for the initial budget proposal. Analogous estimating is a quick method with minimal information, leading to inaccuracies. A more effective technique moving forward would be the 3-point technique, which relies on the expertise of estimators to provide a more accurate estimate by accounting for both positive and negative factors. The 3-point estimating technique includes three key points:

- Most Likely (M) or Best Guess (BG): This reflects the average work required for a task if performed repeatedly by a team member.

- Pessimistic (P) estimate: This indicates the amount of work needed if negative factors come into play.

- Optimistic (O) estimate: This represents the amount of work required if positive risks occur (Indeed, 2023).

Cost Estimate:

Understanding the Work Breakdown Structure (WBS) is essential for assessing project cost estimates and improving the team’s understanding of each task’s associated costs (Organ, 2023). The WBS organizes the project hierarchically, providing a prioritized sequence of tasks.

To break down the WBS, the following four steps should be followed (Organ, 2023):

- Generate a list of high-level requirements or scope deliverables.

- Divide each high-level requirement into categories based on major deliverables.

- Break down these categories into measurable activities.

- Evaluate the work packages for completeness.

According to Organ, utilizing the WBS for initial project estimation significantly improves the chances of successful estimation, planning, and implementation. This approach helps global project teams minimize risks and avoid issues related to change control, scope creep, and project delays.

For the Nearlyfree project, the WBS was constructed following these steps. However, the project’s budgetary issues suggest that the project scope was not adequately considered, making the deliverables potentially unattainable.

Failure Points:

A detailed report from Nearlyfree.com indicates that the project is failing for two main reasons. Firstly, there is a significant gap between the projected budget and the actual costs. Secondly, critical deliverables were omitted during planning, leading to overall project failure.

Delays have also been detrimental, consuming a large portion of the budget. Proper scheduling and planning could have mitigated these delays, allowing the project to use its resources more efficiently. Funds spent on delays could have been used to strengthen other project aspects.

Turnaround Recommendations:

To reverse the project’s course, we recommend the following estimation techniques:

- Total Cost of Ownership (TCO): Assess the comprehensive cost of the project, including direct and indirect expenses. Understanding all associated costs provides a clearer picture of the project’s financial implications.

- Return on Investment (ROI): Analyze potential returns and benefits from the project to determine if the anticipated gains justify the costs.

- Contingency Reserves: Establish reserves to address unforeseen risks and uncertainties, ensuring preparedness for unexpected challenges without jeopardizing project progress.

- 3-point Cost Estimation: Utilize this technique to estimate project costs by considering optimistic, pessimistic, and most likely scenarios, offering a more accurate and realistic cost estimation.

Using these techniques, we aim to revitalize the project and enhance its chances of success by gaining a comprehensive understanding of costs, returns, and potential risks.

Total Cost of Ownership:

Considering the Total Cost of Ownership (TCO) is crucial for turning the project around. TCO helps investors compare a company with its competitors and make informed investment decisions. TCO includes the asset purchase price and operational costs, providing a holistic view of the project’s long-term value (Twin, 2023).

When presenting a revised budget plan, including the TCO is important. This inclusion clarifies not only the initial system cost but also the direct expenses, such as software costs, installation, and employee training, offering a clearer picture than a large overall figure. With the projected TCO at $27,133.33, it is essential to demonstrate the allocation of these funds.

Return on Investment (ROI):

Considering ROI is another approach to project turnaround. While TCO is important, ROI measures the benefits of a capital investment, representing the percentage of total capital cost and predicting investment growth and returns over time (Fernando, 2023).

To calculate ROI, assess both outbound and inbound cash flows related to the investment. Accurate ROI calculation requires a thorough review of every cost (Fernando, 2023). For this project, identifying long-term savings in labor or resources is challenging. By subtracting the projected cost of $27,133.33 from the baseline cost of $30,380, the project savings amount to $3,246.67.

Contingency Reserves:

Considering Contingency Reserves is another option for project turnaround. Contingency Reserves are allocations within the schedule or cost baseline to account for known risks and implement response strategies (Harrin, 2022). Establishing a backup plan is crucial for managing uncertainties and risks in every project. Calculating contingency reserves involves using the Expected Value Method (EMV), multiplying potential loss by the probability of occurrence for known or unknown risks. Multiple risks are combined to determine the total contingency (Harrin, 2022).

Upon reviewing the budget, there is a 90% chance that HR labor costs will exceed the budget, a 50% chance that project manager costs will surpass the allocated amount, and a 75% chance that training expenses will fall short. With an estimated contingency reserve of $5,000, the calculations are as follows:

- 90% of $2,777 equals $2,500

- 50% of $2,500 equals $1,250

- 75% of $3,750 equals $2,812.50

3-point Cost Estimation:

The final option for turning the project around is using the 3-point estimation technique. This method employs optimistic and pessimistic estimates to determine the ideal value for each task (Indeed, 2023). The estimation formula is E = (a + m + b)/3, where E is the estimated value, and a, m, and b are the most likely, pessimistic, and optimistic values, respectively. This is known as the triangular distribution formula.

Reviewing the project documents, it is clear that some tasks exceeded the initial budget. The task with the greatest overage was planning, exceeding the baseline budget by $6,000. Additionally, labor costs for three team members also exceeded expectations. To address future underestimations, we will use the 3-point cost estimation technique and allocate contingency reserves.

The new baseline budget, including the $5,000 contingency reserve, estimates the project cost at $32,133.33.

New Baseline Budget

Appendix

References

Fernando, J. (2023, May 24). Return on investment (ROI): How to calculate it and what it means. Investopedia. https://www.investopedia.com/terms/r/returnoninvestment.asp

Harrin, E. (2022, April 8). Project contingency: The ultimate guide. Rebel’s Guide to Project Management. https://rebelsguidetopm.com/project-contingency/

How does cash flow help in decision making?: Tally solutions. Tally. (2022, July 20). https://tallysolutions.com/accounting/how-does-cash-flow-help-in-decision-making/

Indeed Editorial Team. (2023, February 3). Three-point estimating: Definition, formula and example. Indeed. https://www.indeed.com/career-advice/career-development/three-point-estimating

Fernando, J. (2023, March 30). Internal rate of return (IRR) rule: Definition and example. Investopedia. Retrieved May 2, 2023, from https://www.investopedia.com/terms/i/irr.asp

PM FPX 5333 Assessment 1 Budget Analysis Report

Organ, C. (2023, March 23). Work breakdown structure (WBS) in project management. Forbes. https://www.forbes.com/advisor/business/what-is-work-breakdown-structure/

Twin, A. (2023, January 25). Total cost of ownership: How it’s calculated with example. Investopedia. https://www.invest

Post Categories

Tags

- Annotated Bibliography (2)

- Bioinformatics (1)

- Budget Negotiations (1)

- Capital Budget (1)

- Capstone Video Reflection (1)

- Care Coordination (6)

- Community Health Care (1)

- Community Health Needs (1)

- Community Resources (2)

- Complaint Analysis (4)

- Concept Map (2)

- Curriculum Evaluation (1)

- Curriculum Overview (1)

- Dashboard Metrics Evaluation (1)

- Descriptive Statistics (1)

- Disaster Plan (1)

- Educational Technology (4)

- Enhancing Quality and Safety (1)

- Environmental Analysis (1)

- Evaluating Technology Usage (1)

- Evaluation Plan Design (1)

- Evidence and Resources (1)

- Evidence Based Approach (1)

- Evidence Based Care (1)

- Evidence-Based Change (1)

- Evidence-based Practice (1)

- Evidenced-Based Literature (2)

- Executive Summary (1)

- Exploration of Regulations (1)

- Final Project Submission (1)

- Global Issue (1)

- Health Care (3)

- Health Care Professional (1)

- Health Improvement Plan (1)

- Health Policy Proposal (1)

- Health Promotion Plan (3)

- Healthcare Improvement (2)

- Implementation Plan (2)

- Interdisciplinary Issue Identification (1)

- Interdisciplinary Plan Proposal (1)

- Intervention Strategy (1)

- Leadership and Group Collaboration (2)

- Leadership Reflection Video (1)

- Legal and Ethical Issues (1)

- Literature Review (1)

- Literature Search (1)

- Literature Synthesis (1)

- Managing the Toxic Leader (1)

- Manuscript for Publication (1)

- Media Submission (1)

- Meeting with Stakeholders (1)

- Mentor Interview (1)

- MSN Reflection (1)

- Near-Miss Analysis (1)

- Nurse Educator (1)

- Obesity (2)

- Ontological Humility (1)

- Organizational Change (1)

- Outcome Measures (1)

- Outcomes of the Intervention (1)

- Patient Care Plan (1)

- Patient Care Technology (1)

- Personal Leadership Portrait (2)

- PICOT (3)

- Policy Proposal (1)

- Political Landscape Analysis (1)

- Practicum and Social Justice (1)

- Professional Development (1)

- Professional Development Plan (1)

- Project Charter (4)

- Quality Improvement Proposal (4)

- Quality Performance Improvement (1)

- Research Skills (1)

- Risk Mitigation (1)

- Rubric Development (1)

- Safety Gap Analysis (1)

- Safety Improvement Plan (1)

- Scholarly Article (1)

- Scholarly Sources (2)

- Staff Training Session (1)

- Stakeholder Meeting (1)

- Stakeholder Presentation (1)

- Strategic Plan Appraisal (1)

- Strategic Plan Development (1)

- Strategic Planning (1)

- Technological Changes (1)

- Transitional Care Plan (1)

- Tripartite Model (1)